Table of Content

SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site. The borrower can submit the post – dated EMI cheques by any other Bank account in the nearest Loan Centre of Central Bank of India Bank. It is to be noted that Post Dated Cheques shall be collected only in non – ECS locations.

The online eligibility check facility at the bank’s website enables customers to understand, in a matter of 60 seconds, if they can avail a loan. The possibility of getting 100% finance for the car purchase is an attractive element of the package as well. The Dream Car Loan scheme has given a number of customers the ability of purchasing a dream car.

Home Loan Processing Fee

Allahabad Bank Home Loan - Check lowest Interest Rates, Low EMI, Documents Required details on EMI & Calculate Eligibility Instantly at Deal4loans. The process to get the loan was delayed and the process to close the loan was also a delay. It has not been a very satisfactory experience and the process was not that smooth. Allahabad Bank charges interest on the daily reducing balances of the Home Loan. The customer support team at BankBazaar is trained to address and solve any problem or query that a customer may have.

That way, you will be able to compare home loan interest rates and schemes offered by other financial institutions. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs. This variant of SBI home loan is very useful for young salaried between years. The Flexipay calculator allows you to calculate the EMI division that you pay during the home loan tenure. Before applying, take out some time for doing primary research about the real-estate market and loan to find out which type of home is within your budget?

Best Banks for Home Loan in India in 2022

I took home loan from the INDIAN BANK. The Application easy and hassle free. I applied it , the application process and the documentation was done good which was much more convenient. Their interest rate was also nominal With in few days I got the loan credited to the account. An individual can choose to opt for a loan tenure that’s offered between 12 months and 84 months.

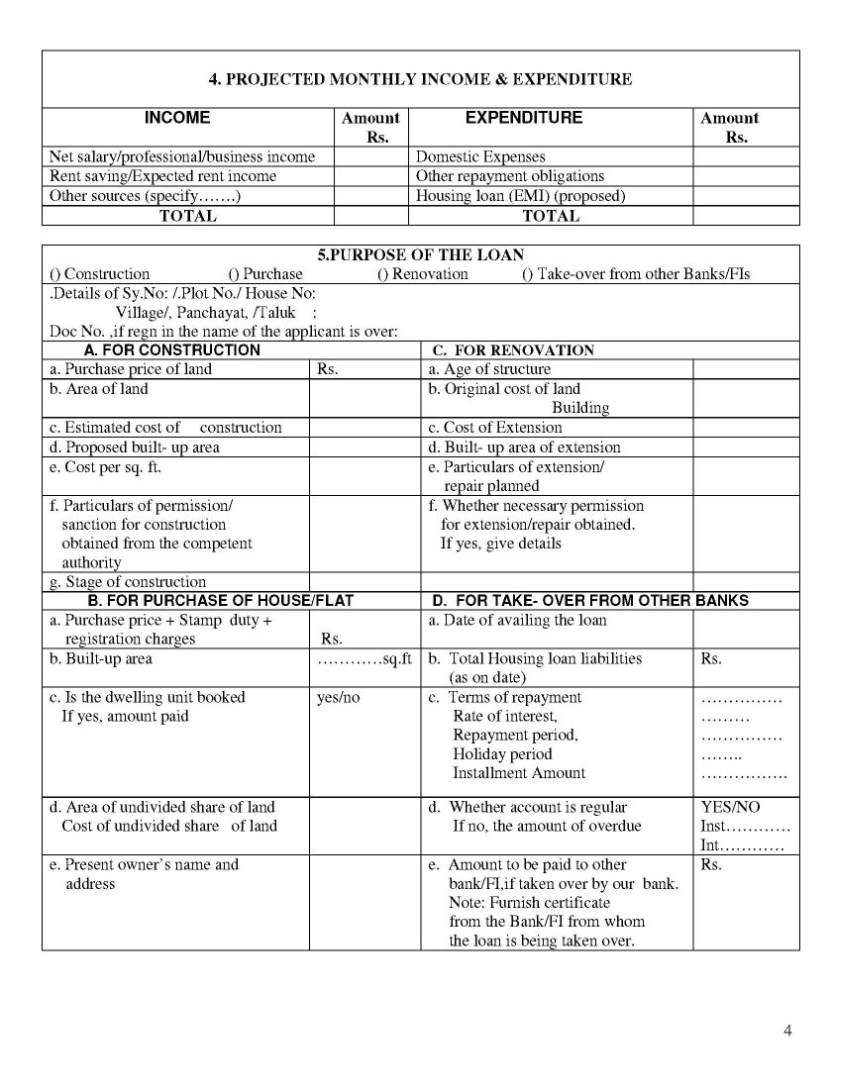

This would include property in prime residential areas with very good resale prospects. Allahabad Bank would need to be able to sell of the property easily in case of a loan default. The NRI should have a minimum annual income that is equal to or more than INR.3 lakhs p.a. Construction of house on land pre – owned by the person. Allahabad Bank Home loan can be availed only by individuals.

Top Bank’s Home Loan Details

Any litigation can cause the loan to be held up and even if Allahabad Bank agrees, the interest rate may be raised. Allahabad Bank provides all modern banking and financial services across institutions, Corporate, MSME and the general public. Amongst its retail, business and commercial loans, its retail sector consisting of mostly Home loans are very popular. This type of loan is specifically for those individuals who are Indian residents with an income of Rs. 2 Lakhs per annum.

Got the home loan from the INDIAN BANK around a year ago. The customer support service is good with the INDIAN BANK and they have disbursed the loan amount within10days of time. The rate of interest and the charges are low and average with the INDIAN BANK home loan services. I have applied for the home loan with the INDIAN BANK where the bank has the no proper customer support added on that the responsiveness is not good with this bank.

That’s because interest accrues over a more extended period. Conversely, a briefer tenure results in higher EMIs, but the total interest is lower. This will not be allowed as the NRI will not be able to show proof of income within the country.

There is tremendous competition among the various nationalised banks in India to offer the best quality of customer service. Allahabad Bank is right up there among its peers in providing quality features and benefits on its loan products. The bank had its headquarters in Allahabad for nearly sixty years until it shifted its base to Kolkata in 1923 for business considerations. This period marked the spread of the bank into the eastern states of India. Today, Allahabad Bank has the highest number of branches in the NE states when compared to other nationalised banks.

In the case of salaried borrowers, the maximum age is 60. The interest rates for these Home Loans in Allahabad Bank is decreasing these days. The interest rates for these banks varies based on the loan amount and other things.

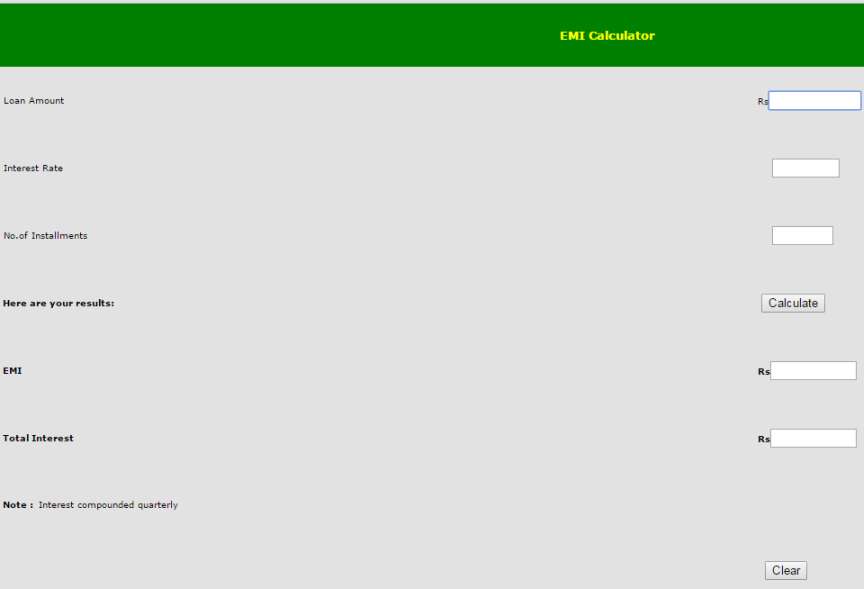

If you provide the right information, you get accurate EMI calculation. Nowadays, you have EMI Calculators to make it easy for the customers to determine their Home Loan EMI. However, one should know the old-fashioned way to calculate the EMI. Where, P is the principal amount, R is the interest rate on a monthly basis, and N is the number of installments. The “Dream Car Loan” scheme enables you to find details about cars that are best suited for your needs. You can research about the new vehicles in the market, compare cars, and read reviews.

Use this simple tool to find out how much EMI you will have to pay for your home Loan. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Past performance is not an indicator of future returns.

No comments:

Post a Comment